Advice from anyone who has worked with or knows about Forex?

Posted by Ryanita

on

Saturday, November 30, 2013

, under

forex trading tutorial

|

comments (0)

Boots

I have watched some tutorials on the Forex site. But I am getting nervous because of all the risk I keep reading online concerning Forex and currency exchange. I will continue watching the videos and take notes as well as set up a practice account. Does anyone have any advice on the subject? What is the best way to start, can you be successful, do you lose more often than you gain? Anything is appreciated.

Answer

Your most important mission is to set up a practice account and make a zillion mistakes over whatever period of time this process may take you (generally speaking expect it to be as long as a year or even more, but of course it could be different)

You would greatly benefit from keeping a careful record of everything pertaining to the trades you're making. What you want to know about your trading is primarily covered by asking yourself this question: Why did I enter that trade? This question will become increasingly easier to answer and "second nature" to you ONLY after you gain experience; that's why this process is so important.

The truth is that you should strive to work with and thoroughly understand the workings of timeframes, chart patterns, support/resistance levels, identifying market trends/direction, entry/exit points, money management, using of leverage, fundamentals effect on the market, etc, to really be equipped enough to trade profitably. Add to that the vital importance of learning to control your emotions as to avoid non-objective/knee-jerk reactive trading.

Ideally and through a process of elimination, you should arrive to a personal system/strategy that proves successful over time. Regardless of what you hear from the naysayers, this is doable, but as you're probably tired of hearing this is certainly NOT EASY... it takes time and dedicated effort like ANYTHING worth accomplishing in life. You will be tested and will be tempted to quit from being frustrated, discouraged, and/or even worse, from excusing your lack of profits by joining the club of those who claim the whole thing is just a scam. (Yes, there are marketeer scammers all over the net who prowl on the naive and uninformed, but be assured that the Forex market is 100% legitimate. You can find successful -professional and private- documented trading records all over the net too.)

Last but not least, it is not true at all that you'll need special "super" computers or equipment to "compete with the pros" as some misguided people here constantly post. A solid platform provided by a reputable broker as well as access to fundamental analysis/quality data is all you'll ever need. But I insist and can't stress enough the fact that knowledge and experience are your best allies and where your time will be best invested. Without these ingredients, your chances at arriving at a working system/strategy are basically null.

Hope that helps and Best of Luck.

Your most important mission is to set up a practice account and make a zillion mistakes over whatever period of time this process may take you (generally speaking expect it to be as long as a year or even more, but of course it could be different)

You would greatly benefit from keeping a careful record of everything pertaining to the trades you're making. What you want to know about your trading is primarily covered by asking yourself this question: Why did I enter that trade? This question will become increasingly easier to answer and "second nature" to you ONLY after you gain experience; that's why this process is so important.

The truth is that you should strive to work with and thoroughly understand the workings of timeframes, chart patterns, support/resistance levels, identifying market trends/direction, entry/exit points, money management, using of leverage, fundamentals effect on the market, etc, to really be equipped enough to trade profitably. Add to that the vital importance of learning to control your emotions as to avoid non-objective/knee-jerk reactive trading.

Ideally and through a process of elimination, you should arrive to a personal system/strategy that proves successful over time. Regardless of what you hear from the naysayers, this is doable, but as you're probably tired of hearing this is certainly NOT EASY... it takes time and dedicated effort like ANYTHING worth accomplishing in life. You will be tested and will be tempted to quit from being frustrated, discouraged, and/or even worse, from excusing your lack of profits by joining the club of those who claim the whole thing is just a scam. (Yes, there are marketeer scammers all over the net who prowl on the naive and uninformed, but be assured that the Forex market is 100% legitimate. You can find successful -professional and private- documented trading records all over the net too.)

Last but not least, it is not true at all that you'll need special "super" computers or equipment to "compete with the pros" as some misguided people here constantly post. A solid platform provided by a reputable broker as well as access to fundamental analysis/quality data is all you'll ever need. But I insist and can't stress enough the fact that knowledge and experience are your best allies and where your time will be best invested. Without these ingredients, your chances at arriving at a working system/strategy are basically null.

Hope that helps and Best of Luck.

How can I learn Forex trading for free?

orbital_i

where can I find tutorials about Forex and the FXCM trading station 2?

Answer

Forex Trading Tips â Part 1

Why do hundreds of thousands online traders and investors trade the forex market every day, and how do they make money doing it?

This two-part report clearly and simply details essential tips on how to avoid typical pitfalls and start making more money in your forex trading.

1.Trade pairs, not currencies â Like any relationship, you have to know both sides. Success or failure in forex trading depends upon being right about both currencies and how they impact one another, not just one.

2.Knowledge is Power â When starting out trading forex online, it is essential that you understand the basics of this market if you want to make the most of your investments.

The main forex influencer is global news and events. For example, say an ECB statement is released on European interest rates which typically will cause a flurry of activity. Most newcomers react violently to news like this and close their positions and subsequently miss out on some of the best trading opportunities by waiting until the market calms down. The potential in the forex market is in the volatility, not in its tranquility.

3.Unambitious trading â Many new traders will place very tight orders in order to take very small profits. This is not a sustainable approach because although you may be profitable in the short run (if you are lucky), you risk losing in the longer term as you have to recover the difference between the bid and the ask price before you can make any profit and this is much more difficult when you make small trades than when you make larger ones.

4.Over-cautious trading â Like the trader who tries to take small incremental profits all the time, the trader who places tight stop losses with a retail forex broker is doomed. As we stated above, you have to give your position a fair chance to demonstrate its ability to produce. If you donât place reasonable stop losses that allow your trade to do so, you will always end up undercutting yourself and losing a small piece of your deposit with every trade.

5.Independence â If you are new to forex, you will either decide to trade your own money or to have a broker trade it for you. So far, so good. But your risk of losing increases exponentially if you either of these two things:

Interfere with what your broker is doing on your behalf (as his strategy might require a long gestation period);

Seek advice from too many sources â multiple input will only result in multiple losses. Take a position, ride with it and then analyse the outcome â by yourself, for yourself.

6.Tiny margins â Margin trading is one of the biggest advantages in trading forex as it allows you to trade amounts far larger than the total of your deposits. However, it can also be dangerous to novice traders as it can appeal to the greed factor that destroys many forex traders. The best guideline is to increase your leverage in line with your experience and success.

7.No strategy â The aim of making money is not a trading strategy. A strategy is your map for how you plan to make money. Your strategy details the approach you are going to take, which currencies you are going to trade and how you will manage your risk. Without a strategy, you may become one of the 90% of new traders that lose their money.

8.Trading Off-Peak Hours â Professional FX traders, option traders, and hedge funds posses a huge advantage over small retail traders during off-peak hours (between 2200 CET and 1000 CET) as they can hedge their positions and move them around when there is far small trade volume is going through (meaning their risk is smaller). The best advice for trading during off peak hours is simple â donât.

9.The only way is up/down â When the market is on its way up, the market is on its way up. When the market is going down, the market is going down. Thatâs it. There are many systems which analyse past trends, but none that can accurately predict the future. But if you acknowledge to yourself that all that is happening at any time is that the market is simply moving, you'll be amazed at how hard it is to blame anyone else.

10.Trade on the news â Most of the really big market moves occur around news time. Trading volume is high and the moves are significant; this means there is no better time to trade than when news is released. This is when the big players adjust their positions and prices change resulting in a serious currency flow.

11.Exiting Trades â If you place a trade and itâs not working out for you, get out. Donât compound your mistake by staying in and hoping for a reversal. If youâre in a winning trade, donât talk yourself out of the position because youâre bored or want to relieve stress; stress is a natural part of trading; get used to it.

12.Donât trade too short-term â If you are aiming to make less than 20 points profit, donât undertake the trade. The spread you are trading on will make the odds against you far too high.

13.Donât be smart â The most successful traders I know keep their trading simple. They donât analyse all day or research historical trends and track web logs and their results are excellent.

14.Tops and Bottoms â There are no real âbargainsâ in trading foreign exchange. Trade in the direction the price is going in and youâre results will be almost guaranteed to improve.

15.Ignoring the technicalsâ Understanding whether the market is over-extended long or short is a key indicator of price action. Spikes occur in the market when it is moving all one way.

16.Emotional Trading â Without that all-important strategy, youâre trades essentially are thoughts only and thoughts are emotions and a very poor foundation for trading. When most of us are upset and emotional, we donât tend to make the wisest decisions. Donât let your emotions sway you.

17.Confidence â Confidence comes from successful trading. If you lose money early in your trading career itâs very difficult to regain it; the trick is not to go off half-cocked; learn the business before you trade. Remember, knowledge is power.

Forex Trading Tips â Part 2

Why do hundreds of thousands online traders and investors trade the forex market every day, and how do they make money doing it?

The second and final part of this report clearly and simply details more essential tips on how to avoid the pitfalls and start making more money in your forex trading.

1.Take it like a man â If you decide to ride a loss, you are simply displaying stupidity and cowardice. It takes guts to accept your loss and wait for tomorrow to try again. Sticking to a bad position ruins lots of traders - permanently. Try to remember that the market often behaves illogically, so donât get commit to any one trade; itâs just a trade. One good trade will not make you a trading success; itâs ongoing regular performance over months and years that makes a good trader.

2.Focus â Fantasising about possible profits and then âspendingâ them before you have realised them is no good. Focus on your current position(s) and place reasonable stop losses at the time you do the trade. Then sit back and enjoy the ride - you have no real control from now on, the market will do what it wants to do.

3.Donât trust demos â Demo trading often causes new traders to learn bad habits. These bad habits, which can be very dangerous in the long run, come about because you are playing with virtual money. Once you know how your brokerâs system works, start trading small amounts and only take the risk you can afford to win or lose.

4.Stick to the strategy â When you make money on a well thought-out strategic trade, donât go and lose half of it next time on a fancy; stick to your strategy and invest profits on the next trade that matches your long-term goals.

5.Trade today â Most successful day traders are highly focused on whatâs happening in the short-term, not what may happen over the next month. If youâre trading with 40 to 60-point stops focus on whatâs happening today as the market will probably move too quickly to consider the long-term future. However, the long-term trends are not unimportant; they will not always help you though if youâre trading intraday.

6.The clues are in the details â The bottom line on your account balance doesnât tell the whole story. Consider individual trade details; analyse your losses and the telling losing streaks. Generally, traders that make money without suffering significant daily losses have the best chance of sustaining positive performance in the long term.

7.Simulated Results â Be very careful and wary about infamous âblack boxâ systems. These so-called trading signal systems do not often explain exactly how the trade signals they generate are produced. Typically, these systems only show their track record of extraordinary results â historical results. Successfully predicting future trade scenarios is altogether more complex. The high-speed algorithmic capabilities of these systems provide significant retrospective trading systems, not ones which will help you trade effectively in the future.

8.Get to know one cross at a time â Each currency pair is unique, and has a unique way of moving in the marketplace. The forces which cause the pair to move up and down are individual to each cross, so study them and learn from your experience and apply your learning to one cross at a time.

9.Risk Reward â If you put a 20 point stop and a 50 point profit your chances of winning are probably about 1-3 against you. In fact, given the spread youâre trading on, itâs more likely to be 1-4. Play the odds the market gives you.

10.Trading for Wrong Reasons â Donât trade if you are bored, unsure or reacting on a whim. The reason that you are bored in the first place is probably because there is no trade to make in the first place. If you are unsure, itâs probably because you canât see the trade to make, so donât make one.

11.Zen Tradingâ Even when you have taken a position in the markets, you should try and think as you would if you hadnât taken one. This level of detachment is essential if you want to retain your clarity of mind and avoid succumbing to emotional impulses and therefore increasing the likelihood of incurring losses. To achieve this, you need to cultivate a calm and relaxed outlook. Trade in brief periods of no more than a few hours at a time and accept that once the trade has been made, itâs out of your hands.

12.Determination â Once you have decided to place a trade, stick to it and let it run its course. This means that if your stop loss is close to being triggered, let it trigger. If you move your stop midway through a tradeâs life, you are more than likely to suffer worse moves against you. Your determination must be show itself when you acknowledge that you got it wrong, so get out.

13.Short-term Moving Average Crossovers â This is one of the most dangerous trade scenarios for non professional traders. When the short-term moving average crosses the longer-term moving average it only means that the average price in the short run is equal to the average price in the longer run. This is neither a bullish nor bearish indication, so donât fall into the trap of believing it is one.

14.Stochastic â Another dangerous scenario. When it first signals an exhausted condition thatâs when the big spike in the âexhaustedâ currency cross tends to occur. My advice is to buy on the first sign of an overbought cross and then sell on the first sign of an oversold one. This approach means that youâll be with the trend and have successfully identified a positive move that still has some way to go. So if percentage K and percentage D are both crossing 80, then buy! (This is the same on sell side, where you sell at 20).

15.One cross is all that counts â EURUSD seems to be trading higher, so you buy GBPUSD because it appears not to have moved yet. This is dangerous. Focus on one cross at a time â if EURUSD looks good to you, then just buy EURUSD.

16.Wrong Broker â A lot of FOREX brokers are in business only to make money from yours. Read forums, blogs and chats around the net to get an unbiased opinion before you choose your broker.

17.Too bullish â Trading statistics show that 90% of most traders will fail at some point. Being too bullish about your trading aptitude can be fatal to your long-term success. You can always learn more about trading the markets, even if you are currently successful in your trades. Stay modest, and keep your eyes open for new ideas and bad habits you might be falling in to.

18.Interpret forex news yourself â Learn to read the source documents of forex news and events - donât rely on the interpretations of news media or others.

Otherwise you can use http://www.forextrading-system.com They have all kind of explanations here and some nice free software

Forex Trading Tips â Part 1

Why do hundreds of thousands online traders and investors trade the forex market every day, and how do they make money doing it?

This two-part report clearly and simply details essential tips on how to avoid typical pitfalls and start making more money in your forex trading.

1.Trade pairs, not currencies â Like any relationship, you have to know both sides. Success or failure in forex trading depends upon being right about both currencies and how they impact one another, not just one.

2.Knowledge is Power â When starting out trading forex online, it is essential that you understand the basics of this market if you want to make the most of your investments.

The main forex influencer is global news and events. For example, say an ECB statement is released on European interest rates which typically will cause a flurry of activity. Most newcomers react violently to news like this and close their positions and subsequently miss out on some of the best trading opportunities by waiting until the market calms down. The potential in the forex market is in the volatility, not in its tranquility.

3.Unambitious trading â Many new traders will place very tight orders in order to take very small profits. This is not a sustainable approach because although you may be profitable in the short run (if you are lucky), you risk losing in the longer term as you have to recover the difference between the bid and the ask price before you can make any profit and this is much more difficult when you make small trades than when you make larger ones.

4.Over-cautious trading â Like the trader who tries to take small incremental profits all the time, the trader who places tight stop losses with a retail forex broker is doomed. As we stated above, you have to give your position a fair chance to demonstrate its ability to produce. If you donât place reasonable stop losses that allow your trade to do so, you will always end up undercutting yourself and losing a small piece of your deposit with every trade.

5.Independence â If you are new to forex, you will either decide to trade your own money or to have a broker trade it for you. So far, so good. But your risk of losing increases exponentially if you either of these two things:

Interfere with what your broker is doing on your behalf (as his strategy might require a long gestation period);

Seek advice from too many sources â multiple input will only result in multiple losses. Take a position, ride with it and then analyse the outcome â by yourself, for yourself.

6.Tiny margins â Margin trading is one of the biggest advantages in trading forex as it allows you to trade amounts far larger than the total of your deposits. However, it can also be dangerous to novice traders as it can appeal to the greed factor that destroys many forex traders. The best guideline is to increase your leverage in line with your experience and success.

7.No strategy â The aim of making money is not a trading strategy. A strategy is your map for how you plan to make money. Your strategy details the approach you are going to take, which currencies you are going to trade and how you will manage your risk. Without a strategy, you may become one of the 90% of new traders that lose their money.

8.Trading Off-Peak Hours â Professional FX traders, option traders, and hedge funds posses a huge advantage over small retail traders during off-peak hours (between 2200 CET and 1000 CET) as they can hedge their positions and move them around when there is far small trade volume is going through (meaning their risk is smaller). The best advice for trading during off peak hours is simple â donât.

9.The only way is up/down â When the market is on its way up, the market is on its way up. When the market is going down, the market is going down. Thatâs it. There are many systems which analyse past trends, but none that can accurately predict the future. But if you acknowledge to yourself that all that is happening at any time is that the market is simply moving, you'll be amazed at how hard it is to blame anyone else.

10.Trade on the news â Most of the really big market moves occur around news time. Trading volume is high and the moves are significant; this means there is no better time to trade than when news is released. This is when the big players adjust their positions and prices change resulting in a serious currency flow.

11.Exiting Trades â If you place a trade and itâs not working out for you, get out. Donât compound your mistake by staying in and hoping for a reversal. If youâre in a winning trade, donât talk yourself out of the position because youâre bored or want to relieve stress; stress is a natural part of trading; get used to it.

12.Donât trade too short-term â If you are aiming to make less than 20 points profit, donât undertake the trade. The spread you are trading on will make the odds against you far too high.

13.Donât be smart â The most successful traders I know keep their trading simple. They donât analyse all day or research historical trends and track web logs and their results are excellent.

14.Tops and Bottoms â There are no real âbargainsâ in trading foreign exchange. Trade in the direction the price is going in and youâre results will be almost guaranteed to improve.

15.Ignoring the technicalsâ Understanding whether the market is over-extended long or short is a key indicator of price action. Spikes occur in the market when it is moving all one way.

16.Emotional Trading â Without that all-important strategy, youâre trades essentially are thoughts only and thoughts are emotions and a very poor foundation for trading. When most of us are upset and emotional, we donât tend to make the wisest decisions. Donât let your emotions sway you.

17.Confidence â Confidence comes from successful trading. If you lose money early in your trading career itâs very difficult to regain it; the trick is not to go off half-cocked; learn the business before you trade. Remember, knowledge is power.

Forex Trading Tips â Part 2

Why do hundreds of thousands online traders and investors trade the forex market every day, and how do they make money doing it?

The second and final part of this report clearly and simply details more essential tips on how to avoid the pitfalls and start making more money in your forex trading.

1.Take it like a man â If you decide to ride a loss, you are simply displaying stupidity and cowardice. It takes guts to accept your loss and wait for tomorrow to try again. Sticking to a bad position ruins lots of traders - permanently. Try to remember that the market often behaves illogically, so donât get commit to any one trade; itâs just a trade. One good trade will not make you a trading success; itâs ongoing regular performance over months and years that makes a good trader.

2.Focus â Fantasising about possible profits and then âspendingâ them before you have realised them is no good. Focus on your current position(s) and place reasonable stop losses at the time you do the trade. Then sit back and enjoy the ride - you have no real control from now on, the market will do what it wants to do.

3.Donât trust demos â Demo trading often causes new traders to learn bad habits. These bad habits, which can be very dangerous in the long run, come about because you are playing with virtual money. Once you know how your brokerâs system works, start trading small amounts and only take the risk you can afford to win or lose.

4.Stick to the strategy â When you make money on a well thought-out strategic trade, donât go and lose half of it next time on a fancy; stick to your strategy and invest profits on the next trade that matches your long-term goals.

5.Trade today â Most successful day traders are highly focused on whatâs happening in the short-term, not what may happen over the next month. If youâre trading with 40 to 60-point stops focus on whatâs happening today as the market will probably move too quickly to consider the long-term future. However, the long-term trends are not unimportant; they will not always help you though if youâre trading intraday.

6.The clues are in the details â The bottom line on your account balance doesnât tell the whole story. Consider individual trade details; analyse your losses and the telling losing streaks. Generally, traders that make money without suffering significant daily losses have the best chance of sustaining positive performance in the long term.

7.Simulated Results â Be very careful and wary about infamous âblack boxâ systems. These so-called trading signal systems do not often explain exactly how the trade signals they generate are produced. Typically, these systems only show their track record of extraordinary results â historical results. Successfully predicting future trade scenarios is altogether more complex. The high-speed algorithmic capabilities of these systems provide significant retrospective trading systems, not ones which will help you trade effectively in the future.

8.Get to know one cross at a time â Each currency pair is unique, and has a unique way of moving in the marketplace. The forces which cause the pair to move up and down are individual to each cross, so study them and learn from your experience and apply your learning to one cross at a time.

9.Risk Reward â If you put a 20 point stop and a 50 point profit your chances of winning are probably about 1-3 against you. In fact, given the spread youâre trading on, itâs more likely to be 1-4. Play the odds the market gives you.

10.Trading for Wrong Reasons â Donât trade if you are bored, unsure or reacting on a whim. The reason that you are bored in the first place is probably because there is no trade to make in the first place. If you are unsure, itâs probably because you canât see the trade to make, so donât make one.

11.Zen Tradingâ Even when you have taken a position in the markets, you should try and think as you would if you hadnât taken one. This level of detachment is essential if you want to retain your clarity of mind and avoid succumbing to emotional impulses and therefore increasing the likelihood of incurring losses. To achieve this, you need to cultivate a calm and relaxed outlook. Trade in brief periods of no more than a few hours at a time and accept that once the trade has been made, itâs out of your hands.

12.Determination â Once you have decided to place a trade, stick to it and let it run its course. This means that if your stop loss is close to being triggered, let it trigger. If you move your stop midway through a tradeâs life, you are more than likely to suffer worse moves against you. Your determination must be show itself when you acknowledge that you got it wrong, so get out.

13.Short-term Moving Average Crossovers â This is one of the most dangerous trade scenarios for non professional traders. When the short-term moving average crosses the longer-term moving average it only means that the average price in the short run is equal to the average price in the longer run. This is neither a bullish nor bearish indication, so donât fall into the trap of believing it is one.

14.Stochastic â Another dangerous scenario. When it first signals an exhausted condition thatâs when the big spike in the âexhaustedâ currency cross tends to occur. My advice is to buy on the first sign of an overbought cross and then sell on the first sign of an oversold one. This approach means that youâll be with the trend and have successfully identified a positive move that still has some way to go. So if percentage K and percentage D are both crossing 80, then buy! (This is the same on sell side, where you sell at 20).

15.One cross is all that counts â EURUSD seems to be trading higher, so you buy GBPUSD because it appears not to have moved yet. This is dangerous. Focus on one cross at a time â if EURUSD looks good to you, then just buy EURUSD.

16.Wrong Broker â A lot of FOREX brokers are in business only to make money from yours. Read forums, blogs and chats around the net to get an unbiased opinion before you choose your broker.

17.Too bullish â Trading statistics show that 90% of most traders will fail at some point. Being too bullish about your trading aptitude can be fatal to your long-term success. You can always learn more about trading the markets, even if you are currently successful in your trades. Stay modest, and keep your eyes open for new ideas and bad habits you might be falling in to.

18.Interpret forex news yourself â Learn to read the source documents of forex news and events - donât rely on the interpretations of news media or others.

Otherwise you can use http://www.forextrading-system.com They have all kind of explanations here and some nice free software

Powered by Yahoo! Answers

Can you share your simple forex trading strategy system?

Posted by Ryanita

on , under

forex trading strategies

|

comments (0)

forex trading strategies

image

hisoka147

If you have a simple forex trading strategy that is very easy to understand kindly share it please. No commercial products.

Answer

Asking people for a simple Forex strategy is like asking people if they have a simple method for playing poker that will allow you to win playing poker experts. There is no simple Forex strategy that works.

Forex is what we call a "zero sum" game. You are making a bet with someone else about whether a currency will rise or fall. For every winner there has to be a loser. If you are smarter than the average player, you may make money. If you are dumber than the average player, you are likely to lose money. Most of the people making the "bets" in Forex are highly trained professionals at banks and other institutions. You are unlikely to beat them at this game using a "simple" strategy.

Actually Forex is not quite a zero sum game. It's a slightly negative sum game as the Forex broker takes a small percentage each time in the spread. It's a small amount but over a hundred trades, it ends up being a considerable amount of money. So the average player is likely to lose money, and remember the average player is a highly trained professional and probably smarter than you.

There is a lot of luck in Forex, and if you play it, you will have some periods of time where you make money. This is usually because you are having a lucky streak, not because you have suddenly become an expert Forex player. However, most people are unwilling to admit their success is due to luck. They become convinced they have a system that works, and lose a lot of money trying to refine it.

Further complicating the problem is the large number of Forex scams on the internet. Most Forex websites are of questionable honesty. You will find many people on the Internet that claim they made a lot of money using Forex. They are usually liars trying to make money. They will say: "Go to Forexcrap . com/q2347." The "q2347" is a signal to the Forexcrap site that you are being referred to them by "q2347." If they sell something to you, "q2347" gets a kickback. These coded signals can be hidden by different methods in the link. Other people will refer you to their own private website or blog for the purpose of trying to get money off you.

I would recommend not trying to do Forex at all, unless you are a trained professional. It's like playing poker with people better than you, with the house constantly taking a small percentage from the pot.

Asking people for a simple Forex strategy is like asking people if they have a simple method for playing poker that will allow you to win playing poker experts. There is no simple Forex strategy that works.

Forex is what we call a "zero sum" game. You are making a bet with someone else about whether a currency will rise or fall. For every winner there has to be a loser. If you are smarter than the average player, you may make money. If you are dumber than the average player, you are likely to lose money. Most of the people making the "bets" in Forex are highly trained professionals at banks and other institutions. You are unlikely to beat them at this game using a "simple" strategy.

Actually Forex is not quite a zero sum game. It's a slightly negative sum game as the Forex broker takes a small percentage each time in the spread. It's a small amount but over a hundred trades, it ends up being a considerable amount of money. So the average player is likely to lose money, and remember the average player is a highly trained professional and probably smarter than you.

There is a lot of luck in Forex, and if you play it, you will have some periods of time where you make money. This is usually because you are having a lucky streak, not because you have suddenly become an expert Forex player. However, most people are unwilling to admit their success is due to luck. They become convinced they have a system that works, and lose a lot of money trying to refine it.

Further complicating the problem is the large number of Forex scams on the internet. Most Forex websites are of questionable honesty. You will find many people on the Internet that claim they made a lot of money using Forex. They are usually liars trying to make money. They will say: "Go to Forexcrap . com/q2347." The "q2347" is a signal to the Forexcrap site that you are being referred to them by "q2347." If they sell something to you, "q2347" gets a kickback. These coded signals can be hidden by different methods in the link. Other people will refer you to their own private website or blog for the purpose of trying to get money off you.

I would recommend not trying to do Forex at all, unless you are a trained professional. It's like playing poker with people better than you, with the house constantly taking a small percentage from the pot.

What is the best Forex trading strategy?

Pedro P

I want to know your Forex strategy, when to buy, when to sell, when to wait.

Answer

You're in for a big, rude surprise..... there is no such thing. Day Trading Forex, Stocks etc can take 3-5 years to master.... assuming you're not one of the 95% that fail within the first year.

To believe someone could pass this type of information on to you via Yahoo Answers means you've got a lot to learn. Trading is an art & a science. Two of the most important factors are psychology and trading money management. Technical Analysis is less than 50% of the "formula".

Two of the most well known FX Traders wrote a book titled;

Millionaire Traders

This book by Kathy Lein & Boris Schlossberg will be the start of many books you'll need to read...... Start here... so you at least get a sense of what you're up against.

http://www.amazon.com/Millionaire-Traders-Everyday-People-Beating/dp/0470452544/ref=sr_1_1?s=books&ie=UTF8&qid=1299186948&sr=1-1

You're in for a big, rude surprise..... there is no such thing. Day Trading Forex, Stocks etc can take 3-5 years to master.... assuming you're not one of the 95% that fail within the first year.

To believe someone could pass this type of information on to you via Yahoo Answers means you've got a lot to learn. Trading is an art & a science. Two of the most important factors are psychology and trading money management. Technical Analysis is less than 50% of the "formula".

Two of the most well known FX Traders wrote a book titled;

Millionaire Traders

This book by Kathy Lein & Boris Schlossberg will be the start of many books you'll need to read...... Start here... so you at least get a sense of what you're up against.

http://www.amazon.com/Millionaire-Traders-Everyday-People-Beating/dp/0470452544/ref=sr_1_1?s=books&ie=UTF8&qid=1299186948&sr=1-1

Powered by Yahoo! Answers

What are the tips and techniques for Forex trading?

Posted by Ryanita

on , under

forex trading tutorial

|

comments (0)

Asthon

Hi, anyone can give me an advice about tips and techniques of Forex trading.

Answer

The best advice I can give you is not to try it; unless and until you have a good understanding of how the market works. Go and borrow books on the subject, and search the internet for tutorials.

The vast majority of inexperienced, amateur forex traders lose money; most of them lose everything they have and eventually exit the field upset, angry, disillusioned, and broke.

Consider this - you are "betting" against seasoned professionals who know everything about risk analysis and management. They are equipped with high speed computers located close to the trading floor, in every country whose currency they trade. They have tens of millions of dollars ready to short or long a currency and trigger margin calls and stop limits.

Most of all, they have more timely information than you - they get their news before you do, and by the time you hear about it, the currency has turned solidly against you.

This is why, among many other reasons, the odds are against you. you could make here & there, but not consistently, and not often, and not big. But you can lose big, and often.

The best advice I can give you is not to try it; unless and until you have a good understanding of how the market works. Go and borrow books on the subject, and search the internet for tutorials.

The vast majority of inexperienced, amateur forex traders lose money; most of them lose everything they have and eventually exit the field upset, angry, disillusioned, and broke.

Consider this - you are "betting" against seasoned professionals who know everything about risk analysis and management. They are equipped with high speed computers located close to the trading floor, in every country whose currency they trade. They have tens of millions of dollars ready to short or long a currency and trigger margin calls and stop limits.

Most of all, they have more timely information than you - they get their news before you do, and by the time you hear about it, the currency has turned solidly against you.

This is why, among many other reasons, the odds are against you. you could make here & there, but not consistently, and not often, and not big. But you can lose big, and often.

Is Options University and Forex Trading for real?

Craig Holl

Okay so i have been looking at some ways to make money and i came across Forex trading. Well the trading actually looks legit, but i'm not so sure about this learning course at options university. Can someone tell me about their experience with this, or if you know an even better way to learn, say from a better book. Also do you have to pay for the options university training course?

Answer

The Forex is real, however there are two forms of "Forex Trading".

"On Exchange" and "Off Exchange" This is a fact that few people know about.

On Exchange currency trading is only offered by two companies at the time I was doing my research. Ducas Copy and FXCM. Only one is American:

FXCM. and they only trade "On Exchange" if you have an account with 25k or more in it. And with them you want to ask for an off shore trade account- so you wont be limited in leverage and your allowed to hedge.

All... yes- I mean ALL the other brokerages trade "OFF EXCHANGE" Gain Capital , ACM, CMS, MB,PFG,easy forex, jforex, to name a few.

"OFF EXCHANGE" means just that- its not traded on the real exchange. What it is traded on is an online game that each company creates themselves. Creates, controls, and alters at will. No different than playing online poker. Your playing against the house and the table is controlled by them. Since they always take the position of the opposing party- its in their best interest that you loose.

Example of how they make you loose: (exerpt from Gain Capital's account contract section 4.2:

____________________________________________________________________

.In cases where the prevailing market represents prices different from the prices GAIN Capital has posted on our screen, GAIN Capital will attempt, on a best efforts basis, to execute trades on or close to the prevailing market prices.These prevailing market prices will be the prices, which are ultimately reflected on the Customer Statements.This may or may not adversely affect customer realized and unrealized gains and losses.

_____________________________________________________________________

This means they are trading your account not using the numbers you are being shown on the screen- but by the real market prices.On the game version you can see- the shoots up so you hit the buy tab- in reality the price dropped- in the game you think you made money- then your statement shows up- showing you lost money that day- there's nothing you can do about it either because you signed the contract that says they are allowed to do all sorts of things to make you loose.

As for the university- save your money! go to FXCM's website- open a practice account- you will have access to all their tutorials- however- all you need to know is to buy when the price drops- then sell when it peaks in the other direction- about 2-7 minutes later. Don't trade on Fridays or when they are making financial announcements on the news. Open an account with at least 25k or you will be trading off exchange Plus- opening an account with anything less wont get you anywhere fast. With 25k you can make 15k a day. I can- so you can too. Never use more than 1/3 of your margin.Don't ever use "stops" Always sit and watch the chart anytime your holding a contract.

good luck!

The Forex is real, however there are two forms of "Forex Trading".

"On Exchange" and "Off Exchange" This is a fact that few people know about.

On Exchange currency trading is only offered by two companies at the time I was doing my research. Ducas Copy and FXCM. Only one is American:

FXCM. and they only trade "On Exchange" if you have an account with 25k or more in it. And with them you want to ask for an off shore trade account- so you wont be limited in leverage and your allowed to hedge.

All... yes- I mean ALL the other brokerages trade "OFF EXCHANGE" Gain Capital , ACM, CMS, MB,PFG,easy forex, jforex, to name a few.

"OFF EXCHANGE" means just that- its not traded on the real exchange. What it is traded on is an online game that each company creates themselves. Creates, controls, and alters at will. No different than playing online poker. Your playing against the house and the table is controlled by them. Since they always take the position of the opposing party- its in their best interest that you loose.

Example of how they make you loose: (exerpt from Gain Capital's account contract section 4.2:

____________________________________________________________________

.In cases where the prevailing market represents prices different from the prices GAIN Capital has posted on our screen, GAIN Capital will attempt, on a best efforts basis, to execute trades on or close to the prevailing market prices.These prevailing market prices will be the prices, which are ultimately reflected on the Customer Statements.This may or may not adversely affect customer realized and unrealized gains and losses.

_____________________________________________________________________

This means they are trading your account not using the numbers you are being shown on the screen- but by the real market prices.On the game version you can see- the shoots up so you hit the buy tab- in reality the price dropped- in the game you think you made money- then your statement shows up- showing you lost money that day- there's nothing you can do about it either because you signed the contract that says they are allowed to do all sorts of things to make you loose.

As for the university- save your money! go to FXCM's website- open a practice account- you will have access to all their tutorials- however- all you need to know is to buy when the price drops- then sell when it peaks in the other direction- about 2-7 minutes later. Don't trade on Fridays or when they are making financial announcements on the news. Open an account with at least 25k or you will be trading off exchange Plus- opening an account with anything less wont get you anywhere fast. With 25k you can make 15k a day. I can- so you can too. Never use more than 1/3 of your margin.Don't ever use "stops" Always sit and watch the chart anytime your holding a contract.

good luck!

Powered by Yahoo! Answers

What is the secret to successful forex trading?

Posted by Ryanita

on , under

forex jargon

|

comments (0)

Jimmy

Can anyone tell me Secret to success in currency trading

Answer

A complete newbie to forex trading, I am having difficulties figuring out where to look for information, but also what exactly to look for. Commodities? Bank quarterly results?

So, you want to learn how to trade currencies in the forex market? The process of trading currencies appears very straight-forward on the surface, but there's more to it than meets the eye.

Currency trading tutorial is about to receive here will give you a basic idea of ââhow things work. However, it should be noted that this tutorial is only scratching the surface. The Forex market is complex, fast and requires more seriously if you want to trade successfully.

Now that we have that the waiver form, let's start by examining the fundamental unity of all those involved in trade: the "currency pair.

What are currency pairs?

Currency pairs are units of two currencies involved in forex trading. For example, if you want to sell U.S. $ to buy euros, which would be in the exchange rate quoted for the EUR / USD. Or, if you wanted to sell Euros to buy U.S. dollars, which would be in the exchange rate quoted for the USD / EUR currency.

You may think, "Are not they the same thing?" Well, most are, but we must look to the right partner, in the correct order, based on the currency you are buying.

There are two reasons for this:

First, it is easier to calculate the results of their exchange in terms of how much of the base currency can be bought with the currency of your 'date'. Your base currency is the currency you intend to buy, and the quote currency is the currency you intend to sell for the base.

When quoting an exchange rate, your broker will list the base currency for the first time the couple and the second currency quoted.

This means that when you see a pair like EUR / USD, which is seeing the cost of 1 euro in U.S. dollars. A listing of the exchange rate of EUR / USD = 1. 4436 means that 1 euro costs U.S. $ 1.4436 Dollars.

Similarly, the USD / EUR pair indicates the cost of U.S. $ 1 in euro terms. An exchange rate of USD / EUR = 0.6834 means that one U.S. dollar costs 0.6834 euros.

The second reason to observe the correct buy / sell ordered pair is that you want to know the difference between the "bid price" the (exchange rate) and the selling price (what the market makers want to currency).

The difference between bid price and the price they ask what is known as "diffusion." Forex traders are subject to spreads when opening or closing operations in the buying. In other words, they are always subject to a margin when they buy, whether to open or close the trade.

Open buy - Dissemination>

Near sell -> no spread

Open sell -> no spread

Close to shopping - broadcast>

Say you want to buy the EUR / USD. The bid price is 1.4436. The price may be something like 1.4440. You must pay the spread of 0. 0004 to make the trade.

Those are the basics of currency trading, but there are other factors to consider. In order to make a profit in the foreign exchange you should also know how to calculate the cash value of exchange rate fluctuations in terms of "points" - or, in the jargon of the currency - 'pips value.

This currency trading tutorial does not cover the values ââof pips, but it is a concept that should be investigated further if you want to master the basics of trading in the forex market.

A complete newbie to forex trading, I am having difficulties figuring out where to look for information, but also what exactly to look for. Commodities? Bank quarterly results?

So, you want to learn how to trade currencies in the forex market? The process of trading currencies appears very straight-forward on the surface, but there's more to it than meets the eye.

Currency trading tutorial is about to receive here will give you a basic idea of ââhow things work. However, it should be noted that this tutorial is only scratching the surface. The Forex market is complex, fast and requires more seriously if you want to trade successfully.

Now that we have that the waiver form, let's start by examining the fundamental unity of all those involved in trade: the "currency pair.

What are currency pairs?

Currency pairs are units of two currencies involved in forex trading. For example, if you want to sell U.S. $ to buy euros, which would be in the exchange rate quoted for the EUR / USD. Or, if you wanted to sell Euros to buy U.S. dollars, which would be in the exchange rate quoted for the USD / EUR currency.

You may think, "Are not they the same thing?" Well, most are, but we must look to the right partner, in the correct order, based on the currency you are buying.

There are two reasons for this:

First, it is easier to calculate the results of their exchange in terms of how much of the base currency can be bought with the currency of your 'date'. Your base currency is the currency you intend to buy, and the quote currency is the currency you intend to sell for the base.

When quoting an exchange rate, your broker will list the base currency for the first time the couple and the second currency quoted.

This means that when you see a pair like EUR / USD, which is seeing the cost of 1 euro in U.S. dollars. A listing of the exchange rate of EUR / USD = 1. 4436 means that 1 euro costs U.S. $ 1.4436 Dollars.

Similarly, the USD / EUR pair indicates the cost of U.S. $ 1 in euro terms. An exchange rate of USD / EUR = 0.6834 means that one U.S. dollar costs 0.6834 euros.

The second reason to observe the correct buy / sell ordered pair is that you want to know the difference between the "bid price" the (exchange rate) and the selling price (what the market makers want to currency).

The difference between bid price and the price they ask what is known as "diffusion." Forex traders are subject to spreads when opening or closing operations in the buying. In other words, they are always subject to a margin when they buy, whether to open or close the trade.

Open buy - Dissemination>

Near sell -> no spread

Open sell -> no spread

Close to shopping - broadcast>

Say you want to buy the EUR / USD. The bid price is 1.4436. The price may be something like 1.4440. You must pay the spread of 0. 0004 to make the trade.

Those are the basics of currency trading, but there are other factors to consider. In order to make a profit in the foreign exchange you should also know how to calculate the cash value of exchange rate fluctuations in terms of "points" - or, in the jargon of the currency - 'pips value.

This currency trading tutorial does not cover the values ââof pips, but it is a concept that should be investigated further if you want to master the basics of trading in the forex market.

what determines exchange rates in forex market?

mm

Answer

What Determines Foreign Exchange (Currency) Rates

There are number of factors that contribute to changes in Forex rates. Below are some of them.

1. Interest rate movements

A rational investor will often look for the best place, in terms of returns, to park their money. If interest rates were high and outlook for the stock market is grim for example, then currency might be the better option (more attractive). Then, currency becomes more expensive due to the high demand..

Also, if you look at two countries. For example, the United States of America and Australia. Australia, at the present moment, has a higher interest rate than the US of A. Thus it makes more sense to park money here in Australia than in the US, thus earning a higher interest. Again, this will drive US Dollars down and push the Aussie Dollars up. This is what you call as⦠CARRY TRADE.

2. Central Banks Manipulation

A Central Bank can be a major player in the Forex market. It can buy and sell large sums of currencies to manipulate the market. There are many reasons to why central banks do this, but they will not be discussed here.

Bank Negara Malaysia was an influential player in the Forex market, to the point of getting a warning from Alan Greenspan, the then chairman of US Federal Reserve.

Also, referring to the 1st factor of interest rate movements, the central bank is the setter of interest rates.

3. Speculators/Traders

Pretty similar with above, the big players in the market like institutions or just people with heaps of money, they can influence Forex market movements by buying or selling large sums of currencies.

4. Unexpected News Announcements

Any unexpected political and economical news announcements can also cause movements in the Forex market.

5. Balance of Payments

Okay, this involves a few jargons like balance of payments, export, import, current accounts, deficits, and surpluses. Iâll just put them in an example.

Suppose a country is exporting goods & services more than it is importing, resulting in more money coming into the country. In this instance, the state of current account surplus is to be expected (letâs just assume that is in surplus). Large current account surplus will make the currency to appreciate.

Contrast this with a country that imports more than it exports (i.e. more money going out than coming in), in which current account deficits will exist (letâs just assume that it is in deficit). In this instance, the currency will depreciate.

All in all, we can conclude that at the end of the day, Forex rates are determined by supply and demand. If there is a high demand for a particular currency, it will appreciate. If there is a low demand for a particular currency, it will depreciate.

What Determines Foreign Exchange (Currency) Rates

There are number of factors that contribute to changes in Forex rates. Below are some of them.

1. Interest rate movements

A rational investor will often look for the best place, in terms of returns, to park their money. If interest rates were high and outlook for the stock market is grim for example, then currency might be the better option (more attractive). Then, currency becomes more expensive due to the high demand..

Also, if you look at two countries. For example, the United States of America and Australia. Australia, at the present moment, has a higher interest rate than the US of A. Thus it makes more sense to park money here in Australia than in the US, thus earning a higher interest. Again, this will drive US Dollars down and push the Aussie Dollars up. This is what you call as⦠CARRY TRADE.

2. Central Banks Manipulation

A Central Bank can be a major player in the Forex market. It can buy and sell large sums of currencies to manipulate the market. There are many reasons to why central banks do this, but they will not be discussed here.

Bank Negara Malaysia was an influential player in the Forex market, to the point of getting a warning from Alan Greenspan, the then chairman of US Federal Reserve.

Also, referring to the 1st factor of interest rate movements, the central bank is the setter of interest rates.

3. Speculators/Traders

Pretty similar with above, the big players in the market like institutions or just people with heaps of money, they can influence Forex market movements by buying or selling large sums of currencies.

4. Unexpected News Announcements

Any unexpected political and economical news announcements can also cause movements in the Forex market.

5. Balance of Payments

Okay, this involves a few jargons like balance of payments, export, import, current accounts, deficits, and surpluses. Iâll just put them in an example.

Suppose a country is exporting goods & services more than it is importing, resulting in more money coming into the country. In this instance, the state of current account surplus is to be expected (letâs just assume that is in surplus). Large current account surplus will make the currency to appreciate.

Contrast this with a country that imports more than it exports (i.e. more money going out than coming in), in which current account deficits will exist (letâs just assume that it is in deficit). In this instance, the currency will depreciate.

All in all, we can conclude that at the end of the day, Forex rates are determined by supply and demand. If there is a high demand for a particular currency, it will appreciate. If there is a low demand for a particular currency, it will depreciate.

Powered by Yahoo! Answers

How many pips does the average retail forex trader make?

Posted by Ryanita

on , under

forex definition

|

comments (0)

Todd J

I'm trying to trade forex on my own, with 3 strategies based primarily on technical analysis, supplemented by fundamental analysis. I've developed these strategies through homework, lots of reading and just a bunch of research. I bought a system in the past and got burned. Now I'm doing it myself. Does anyone know the honest average range of pips professional retail traders make every month? My impression was that they make an average 250-500 pips a month. Not to say they do that every month, it's just the result when averaged out. Right now, after 2 months of trading, I've made a little over 200 pips and I'm hoping to maintain that and improve to the 250-500 pip average a month range. Is that realistic? Ideal? What should be my target monthly average to be a truly successful forex trader.

Answer

It is not wise to have a monthly pip target. If you fall behind your average it is easy to freak out during the last week of the month and make irrational decisions based on greed or fear. The easy way to target your trading is to set a daily pip target or what I like to call a Minimum Acceptable Target (MAP).

15 pips seems to be a conservative daily goal that if hit, will give you over 300 pips per month.

The definition of a "successful Forex trader" is in the eyes of the beholder. What is successful for one might not meet the expectations of another. Personally, I like having a target of increasing my investment portfolio by at least 8% per month.

Good luck with your strategies.

Paul

It is not wise to have a monthly pip target. If you fall behind your average it is easy to freak out during the last week of the month and make irrational decisions based on greed or fear. The easy way to target your trading is to set a daily pip target or what I like to call a Minimum Acceptable Target (MAP).

15 pips seems to be a conservative daily goal that if hit, will give you over 300 pips per month.

The definition of a "successful Forex trader" is in the eyes of the beholder. What is successful for one might not meet the expectations of another. Personally, I like having a target of increasing my investment portfolio by at least 8% per month.

Good luck with your strategies.

Paul

What are the pros/cons of trading one given class of financial assets as opposed to another?

Alex G

Day trading or longer-term trading..

For stocks, commodity futures, FOREX, etc.

For instance, what are the benefits and disadvantages or trading stocks as opposed to oil futures?

Thanks a lot, I'm just curious as to why some people choose to only trade FOREX or only trade commodities when the underlying strategies and principles seem similar enough

Answer

There are many advantages to forex trading as compared to the stock market. However, beware that some of these advantages can be a double edged sword if you are not careful or donât have the knowledge to take proper advantage of them while at the same time guarding against losses.

1. Market Open 24 hours a day.

You can conduct business twenty-four hours a day with forex. Stock market traders on the other hand have a limited time when they can trade. This âperpetual open marketâ is very handy for people who are just starting out trading forex. Stocks force you to trade only when the stock markets are open, but with forex you can schedule your trading whenever it is convenient for you.

2. Margin = Leverage.

The ability to trade on margin gives forex traders significant leverage in their trading and offers the potential to make extraordinary profits with relatively small investments. For example, with a broker that allows margin of 100:1 you can purchase $100,000 in currency with only a $1,000 deposit. Of course, leverage goes both ways and can lead to large losses if you are not careful.

3. Liquidity and Trade Execution Time.

You are trading in cash when trading forex. Stock markets on the other hand require an active seller of a particular stock. Thereâs no investment more liquid than cash, so forex trades are executed near instantaneously. Thereâs no sitting around waiting for your trade to execute.

4. Market Not Easily Influenced by Individuals.

The foreign exchange market is so incredibly huge that no one individual, fund, bank, or government entity can influence it for long. This is the opposite of the stock market where one negative appraisal of a companyâs stock could send it into a tailspin.

5. Only a Few Major Currencies to Follow vs Thousands of Stocks.

There are only seven major currencies to follow when trading forex. Stock markets on the other hand have thousands of stocks available to trade not to mention new IPOs to evaluate on a regular basis. Following them all is all but impossible. With forex you can devote a lot more time to each of the seven major currencies. Some traders specialize in just 3 or 4 currencies and narrow their focus even further.

6. No Bear Markets.

you are trading to predict the direction of currencies either up or down with forex. Stocks on the other hand can experience long bear markets where seemingly everything is going down. Trading forex currency pairs is by definition an activity where you are predicting which currency will be going up and which one will be going down with every single trade. All you need to do to succeed is predict correctly, not always as easy as it sounds!

There are many advantages to forex trading as compared to the stock market. However, beware that some of these advantages can be a double edged sword if you are not careful or donât have the knowledge to take proper advantage of them while at the same time guarding against losses.

1. Market Open 24 hours a day.

You can conduct business twenty-four hours a day with forex. Stock market traders on the other hand have a limited time when they can trade. This âperpetual open marketâ is very handy for people who are just starting out trading forex. Stocks force you to trade only when the stock markets are open, but with forex you can schedule your trading whenever it is convenient for you.

2. Margin = Leverage.

The ability to trade on margin gives forex traders significant leverage in their trading and offers the potential to make extraordinary profits with relatively small investments. For example, with a broker that allows margin of 100:1 you can purchase $100,000 in currency with only a $1,000 deposit. Of course, leverage goes both ways and can lead to large losses if you are not careful.

3. Liquidity and Trade Execution Time.

You are trading in cash when trading forex. Stock markets on the other hand require an active seller of a particular stock. Thereâs no investment more liquid than cash, so forex trades are executed near instantaneously. Thereâs no sitting around waiting for your trade to execute.

4. Market Not Easily Influenced by Individuals.

The foreign exchange market is so incredibly huge that no one individual, fund, bank, or government entity can influence it for long. This is the opposite of the stock market where one negative appraisal of a companyâs stock could send it into a tailspin.

5. Only a Few Major Currencies to Follow vs Thousands of Stocks.

There are only seven major currencies to follow when trading forex. Stock markets on the other hand have thousands of stocks available to trade not to mention new IPOs to evaluate on a regular basis. Following them all is all but impossible. With forex you can devote a lot more time to each of the seven major currencies. Some traders specialize in just 3 or 4 currencies and narrow their focus even further.

6. No Bear Markets.

you are trading to predict the direction of currencies either up or down with forex. Stocks on the other hand can experience long bear markets where seemingly everything is going down. Trading forex currency pairs is by definition an activity where you are predicting which currency will be going up and which one will be going down with every single trade. All you need to do to succeed is predict correctly, not always as easy as it sounds!

Powered by Yahoo! Answers

How does forex work when buying and selling?

Posted by Ryanita

on , under

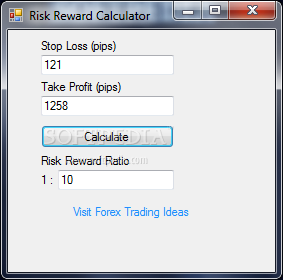

forex risk calculator

|

comments (0)

Gopher

So if i want to buy jpy/aud or anything that does not have us dollars in it how would it work. Would i convert my us dollars into japanese yen when i buy it. Then when i sell it i convert the jpy into aud then i once again convert it into usd. I am really confused can someone help me. When i pay the broker their cut for being the middle man do they take percentage in usd or jpy or british pounds or what.

Answer

It depends which currency your brokerage account is ,

I'm in New Zealand and have a forex account in Australia, so it's balance is displayed in AUD.

When I do a trade on the USD/EUR pair, I'm just playing with the EUR/USD rate - all of the calculations are done in AUD.

I think forex peace army and babypips have the best free training.

You need to read up on money/risk management before you start and having a position size calculator will help when you first start out

Good luck

It depends which currency your brokerage account is ,

I'm in New Zealand and have a forex account in Australia, so it's balance is displayed in AUD.

When I do a trade on the USD/EUR pair, I'm just playing with the EUR/USD rate - all of the calculations are done in AUD.

I think forex peace army and babypips have the best free training.

You need to read up on money/risk management before you start and having a position size calculator will help when you first start out

Good luck

How to pyramid on forex?

Prince

Hi all!

I wonder,how and when to pyramid as soon as I see that trade is profitable.

Is there any kind of indicator,calculator,tutorial,etc which can help me?

Thanks

Answer

What do you mean by Pyramid? You mean adding on to a position or you mean compounding your account to increase it's size.

For adding on, I don't recommend it unless you are confident with the strength of the trend to drop a little more risk in. It's a good idea to lock in profits of your already profitable position with a +ve stop loss as well.

I don't recommend compounding either, at least until you have withdrawn your profits up till the stage where you have taken your initial capital back so all you are left with is pure profits as risk capital. For instance, you deposited $10k, don't compound until you withdraw at least $10k again. My personal habit is to withdraw some or all of the week's profits on Fridays. After all, aren't we trading to make a profit and reap the benefits of those profits by restocking our bank accounts?

What do you mean by Pyramid? You mean adding on to a position or you mean compounding your account to increase it's size.

For adding on, I don't recommend it unless you are confident with the strength of the trend to drop a little more risk in. It's a good idea to lock in profits of your already profitable position with a +ve stop loss as well.

I don't recommend compounding either, at least until you have withdrawn your profits up till the stage where you have taken your initial capital back so all you are left with is pure profits as risk capital. For instance, you deposited $10k, don't compound until you withdraw at least $10k again. My personal habit is to withdraw some or all of the week's profits on Fridays. After all, aren't we trading to make a profit and reap the benefits of those profits by restocking our bank accounts?

Powered by Yahoo! Answers

What is the best Forex Trading strategy in a dealing simulation (over-the-counter)?

Posted by Ryanita

on

Friday, November 29, 2013

, under

forex quotes charts

|

comments (1)

Mundane

Currently a university student in Australia, majoring in Economics and Finance. This semester, I am doing a finance course where I am expected to go to a dealing room and start trading - dealing simulation. So, there will be two groups where companies will be quoting from banks (companies and banks).

I'm out of ideas as to how I should trade and be the best in the dealing room, in terms of strategy. Any ideas? Five stars for best answer. Thanks!

Answer

Download NinjaTrader for free and use their built-in simulator and start trading now real-time, with professional indicators and charts. At the very least, you'll get a feel for actual trading and terms and definitions and what it all means. Your finance class should give you ideas on how to make money. Otherwise, email me, and I'll send you some ebooks on Forex trading. You'll have to send me your email address for me to send an attachment.

http://www.ampfutures.com/index.php

They won't require you to fund the account for several months, maybe six months. The data feeds for forex and futures are also free.

You can also download ThinkOrSwim for free also, but won't have access to the data for export/import into Excel or other program, where Ninjatrader you do. Ninjatrader is great for the small trader, and you can start with as little as $500.

http://www.babypips.com/school/market_hours.html

http://news.tradingcharts.com/forex/headlines/Forex.html

http://forex-trading.bluecollarnews.com...

http://www.forex-learning.com/forex-trading-technical-analysis/forex-trading-technical-analysis

useful e books:

http://www.rapidforex.com/

http://www.traderssecretcode.com...

http://www.1forextrading.com/

http://forexmarketsuccess.com/forex-ebook/

Forex simulator:

http://fxtrader.investopedia.com/Registration/Register4.aspx

Download NinjaTrader for free and use their built-in simulator and start trading now real-time, with professional indicators and charts. At the very least, you'll get a feel for actual trading and terms and definitions and what it all means. Your finance class should give you ideas on how to make money. Otherwise, email me, and I'll send you some ebooks on Forex trading. You'll have to send me your email address for me to send an attachment.

http://www.ampfutures.com/index.php

They won't require you to fund the account for several months, maybe six months. The data feeds for forex and futures are also free.

You can also download ThinkOrSwim for free also, but won't have access to the data for export/import into Excel or other program, where Ninjatrader you do. Ninjatrader is great for the small trader, and you can start with as little as $500.

http://www.babypips.com/school/market_hours.html

http://news.tradingcharts.com/forex/headlines/Forex.html

http://forex-trading.bluecollarnews.com...

http://www.forex-learning.com/forex-trading-technical-analysis/forex-trading-technical-analysis

useful e books:

http://www.rapidforex.com/

http://www.traderssecretcode.com...

http://www.1forextrading.com/

http://forexmarketsuccess.com/forex-ebook/

Forex simulator:

http://fxtrader.investopedia.com/Registration/Register4.aspx

How can I get started with Forex Trading/ What sites are legit?

MyKind

Hello, so i have been trying to figure some ways I can start making money online and I have looked for a while and I know it takes work but one thing i was interested in was something I found called forex trading, however I have not been able to find a clear guide on where to get started and what sites are legit, please help I just want a steady income online , not big bucks or anything

Answer

There are many free resources such as articles, ebooks, website...etc on internet.

These are some basics you should know before you trade:

- how does forex trading work?

- what are the major currencies and different sessions (e.g. EUR/USD, London, New York, Tokyo, Sydney sessions)

- how to read quotes/charts (e.g. buy/sell, candlestick...etc)

- learn technical analysis (e.g. moving average, MACD....etc) or fundamental analysis (e.g. news...etc)

then

- choose a broker and open a demo account (there are many brokers out there and most of them provide free demo account)

- keep learning and trading demo until you find a strategy that suits you and can make profits constantly.

- open a real account with real money.

To be a successful trader, these things are very important:

- mindset

- money management

- find a strategy that suits you

- have a trading plan and follow it

There are too much to mention here. Feel free to visit the website provided or contact me if you have any question. I am more than happy to help.

There are many free resources such as articles, ebooks, website...etc on internet.

These are some basics you should know before you trade:

- how does forex trading work?

- what are the major currencies and different sessions (e.g. EUR/USD, London, New York, Tokyo, Sydney sessions)

- how to read quotes/charts (e.g. buy/sell, candlestick...etc)

- learn technical analysis (e.g. moving average, MACD....etc) or fundamental analysis (e.g. news...etc)

then

- choose a broker and open a demo account (there are many brokers out there and most of them provide free demo account)

- keep learning and trading demo until you find a strategy that suits you and can make profits constantly.

- open a real account with real money.

To be a successful trader, these things are very important:

- mindset

- money management

- find a strategy that suits you

- have a trading plan and follow it

There are too much to mention here. Feel free to visit the website provided or contact me if you have any question. I am more than happy to help.

Powered by Yahoo! Answers

How are currency exchange rates calculated?

Posted by Ryanita

on , under

forex currency rates

|

comments (0)

Chris B

The US Dollar is declining in value against the British Pound and the Euro, but the decline versus the Euro is greater.

If US interest rates are reset lower, I am told that the value of the Dollar versus the other currencies declines further.

These exchange rates are calculated to four decimal places, indicating significant precision.

If the Chinese Yuan is set higher than it currently is, what will that do to the Dollar versus the Pound and the Euro?

Answer

Exchange rates are not calculated the are determined by the currency exchange markets where traders by and sell currencies. see FOREX.